Today the Financial Conduct Authority (FCA), the Government’s consumer credit watchdog, announced new rules to cap the total cost of payday loans.

The new rules introduce:

- An initial cost cap of 0.8% per day - For all high-cost short-term credit loans, interest and fees must not exceed 0.8% per day of the amount borrowed.

- Fixed default fees capped at £15 - If borrowers do not repay their loans on time, default charges must not exceed £15. Interest on unpaid balances and default charges must not exceed the initial rate.

- A total cost cap of 100% - Borrowers must never have to pay back more in fees and interest than the amount borrowed.

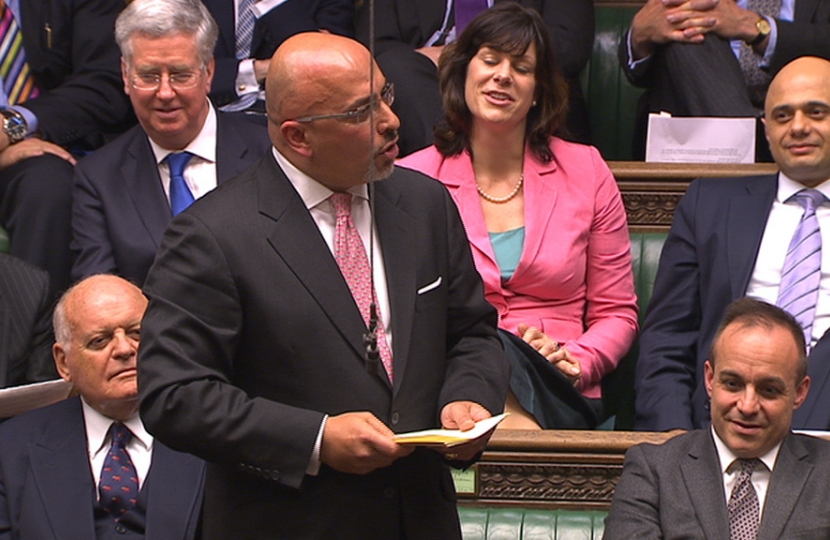

These changes are warmly welcomed by Nadhim, who is a longstanding critic of the worst practises employed by payday loans firms and has called for stronger regulation in Parliament. "

Commenting, Nadhim said: "I’m very pleased to see the FCA is taking a tough stance with this industry. These rules will protect borrowers and help drive the most rapacious firms out of business. In the longer term we must continue to improve household incomes through lower taxes, investment in skills and a strong economy, so that people don’t have to resort to these companies in the first place."